The TCFD journey: A roadmap

- Post Date

- 30 June 2022

- Read Time

- 8 minutes

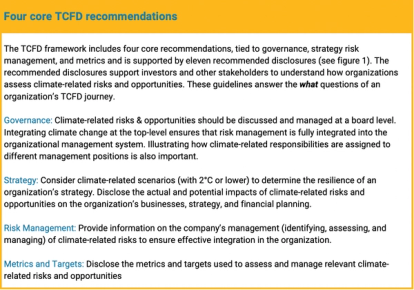

The most significant risks that organisations face today are related to climate change. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations help organisations to understand and prepare for climate-related risks and capitalise on climate-related opportunities relevant to them. This article elaborates on the most important TCFD requirements, explains how organisations can integrate the recommendations and the downloadable roadmap outlines the 6 phases of the TCFD journey and suggests key activities, outcomes, and tools for each phase.

Today, around 3,400 organisations support TCFD, proving that many organisations have started their TCFD journey. However, knowing where to start and how to go about approaching the four core elements (also referred to as the pillars) supported by the eleven recommended disclosures can be confusing.

Why organisations need to understand the importance of TCFD

With climate change increasingly becoming one of the top three material issues for organisations due to having a felt impact on their business, it is becoming a forefront topic. In S&P Global’s 2021 Corporate Sustainability Assessment (CSA), 23% of surveyed companies included climate change as a material issue, compared to 17% the prior year 1.

Recent developments show that the integration of climate and subsequently TCFD is growing in importance for non-financial reporting which means companies must prepare for mandatory disclosure rules. A survey conducted by S&P Global revealed that a high percentage of companies classified in the carbon-intensive sectors (with greater exposure to transition- and physical- risks) have started integrating TCFD. While 60% of energy firms surveyed are already reporting fully or partially in line with the TCFD’s 11 disclosure recommendations (see figure 1), only 16.5% of companies from the health care industry surveyed integrated TCFD into risk management. These results show an improvement-point in the major gap between different industries.

The fact that TCFD reporting is starting to be compulsory in New Zealand, Japan, and recently in the UK2 (with the G73 agreeing to make TCFD-aligned reporting mandatory) further emphasises this point. With these stronger regulatory requirements, today 3,400 companies in 95 jurisdictions support TCFD. In line with this, several ESG benchmarks have implemented TCFD recommendations into their existing standards. Two well-known benchmarks are the Climate Change Questionnaire (CDP) and the CSA, supporting companies to understand the effects of climate change and identifying flaws in their public disclosure.

Nonetheless, TCFD should not simply be seen as another reporting framework or a box that organisations need to tick - it goes beyond the public reporting on climate risks, it assists in understanding risks and opportunities arising from climate change.

Using TCFD to unlock potential

- TCFD enables organisations to better understand themselves as it reveals status quos and how climate change could affect its people and business operations (risk management). This can showcase the flaws in companies’ current climate strategy. Aligning a climate strategy with the TCFD recommendations enables informed strategic decision-making for the future and ensures organisations prepare better for an effective net-zero journey.

- TCFD should not just be seen as a framework to identify climate risks, but also for a tool that identifies opportunities. Opportunities should be embedded into the risk framework and can support organisations to find new business opportunities.

- With climate change often being centralised within the sustainability team, the opportunity to create awareness and identify climate-related opportunities are often overlooked. By implementing TCFD recommendations, different organisational areas are mobilised (governance, strategy, and risk management) and the barriers between different departments are eliminated.

- The clear and consistent reporting of TCFD leads to informed investment decisions and reduced capital loss.

Figure 1: TCFD Recommendations and supporting recommended disclosures

How companies can put TCFD recommendations into action

Despite the fact that climate risks differ according to industry and geographical location, the public disclosure requirements and recommendations from TCFD are widely adopted and applicable to organisations across sectors and jurisdictions.

The downloadable roadmap outlines six phases of the TCFD journey. Approaching the process by using the roadmap will help organisations better understand how to include the TCFD recommendations and align and accelerate on TCFD. The 6 phases include:

- The first phase is to kick-off the project by defining the purpose and context and by attending a ‘TCFD for rookies’ workshop, to make sure that everyone involved in the project has the same level of TCFD knowledge.

- The second phase is to review what peers are doing and conduct a gap analysis based on the TCFD disclosure recommendations. This phase will showcase the readiness of a company to align with TCFD.

- In the third phase climate-related risks and opportunities are defined by using for instance, the internal risk framework and by conducting extensive desk research. By mapping risks and opportunities companies get a clear understanding of what the exact risks and opportunities are and how they impact the business.

- After risks and opportunities are defined, in phase four climate-related scenarios are to be analysed and risks and opportunities are quantified according to the business model.

- Phase five integrates the findings into the company’s strategy through ideation sessions and using the business model canvas.

- The final and sixth phase, is about integrating TCFD into the report and conducting a disclosure gap analysis.

More organisations are embarking on the TCFD journey

Although it is estimated that almost 3,400 organisations have embarked on the TCFD journey, the latest Financial Stability Board’s report shows that companies are struggling to adopt the recommended disclosure requirements (see figure 1). For instance, in 2022 only 13% of organisations, disclosed information on the resilience of their strategy (strategy-C). This is a substantial aspect as it reveals how resilient a company’s strategy is to changing climate.

The flip-side of the coin is that best-practice examples show that there are organisations that have already assessed their resilience. The company Lendlease (classified in the materials and building industry) discloses the resilience of its strategy, by outlining the three climate scenarios, Polarisation scenario (>3ºC), Paris Alignment scenario (2–3ºC), and Transformation scenario (<2ºC). For each scenario, Lendlease elaborates on the different climate related-impacts and the residual sensitivity, which is split into development, construction, and investment.

Another example of how to integrate resilience into strategy is Allianz Group. The company outlines two climate scenarios (2ºC and 1.5ºC) and includes different years. Furthermore, the company goes ahead to rank the risks from low to very high and then classifies them into risk enhancers and risk mitigatory categories.

With 37% of organisations disclosing data on Scope 1,2,3 GHG-emissions (metrics and targets-B), it seems that organisations still have some way to go to accelerate their net-zero strategies. Transportations company Maersk serves as a best-practice example, disclosing information according to recommendations for Scope 1,2, and 3 in metrics and targets, category B. Maersk is describing its Scope 1-3 emissions and states the sources of primary emissions from Scope 3. The company committed to net-zero across the business and value chain by 2040 and is aligned with the science-based targets.

Finch & Beak provides TCFD and climate strategy support

At Finch & Beak, our purpose is to accelerate sustainability within the business of our clients. Together with our fellow companies from SLR, we offer a wide range of TCFD support services such as:

- TCFD readiness assessments

- Risk & opportunity assessments including physical risk analysis of sites

- Scenario analysis using detailed location-specific climate variables and value at risk data from CLIMSystems

- Full TCFD aupport

If your organisation requires support on its TCFD journey, reach out to Johana Schlotter, at [email protected] or call +31 6 28 02 18 80 to discuss how Finch & Beak can help you.

Photo by Constant Loubier on Unsplash

1S&P Global (2022): More companies calling climate change a 'material issue’ as stress testing gains traction.

2Premium listed companies need to disclose alignment with TCFD for financial year starting January 2021 in a comply and explain basis.

3US, France, Germany, UK and Japan